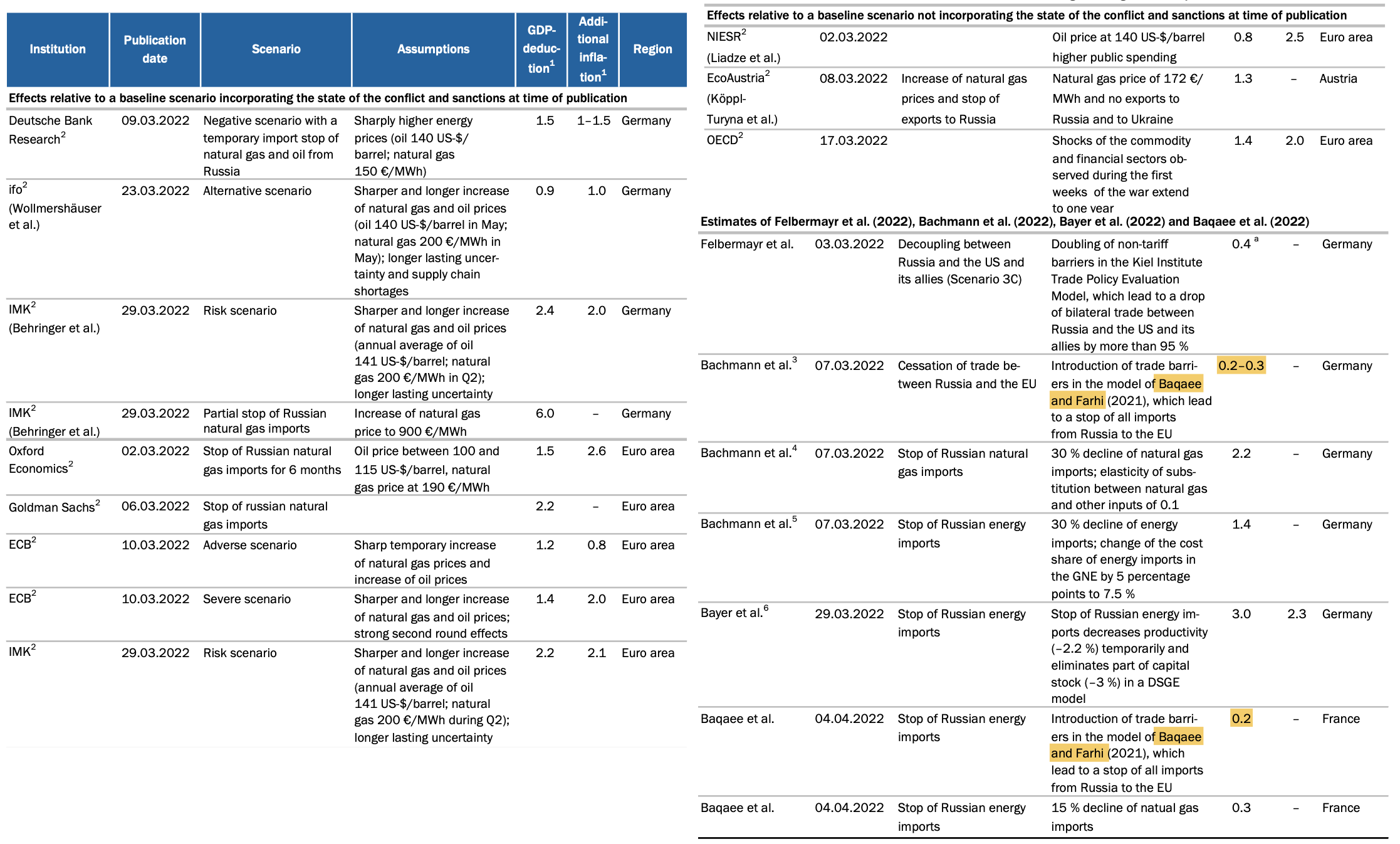

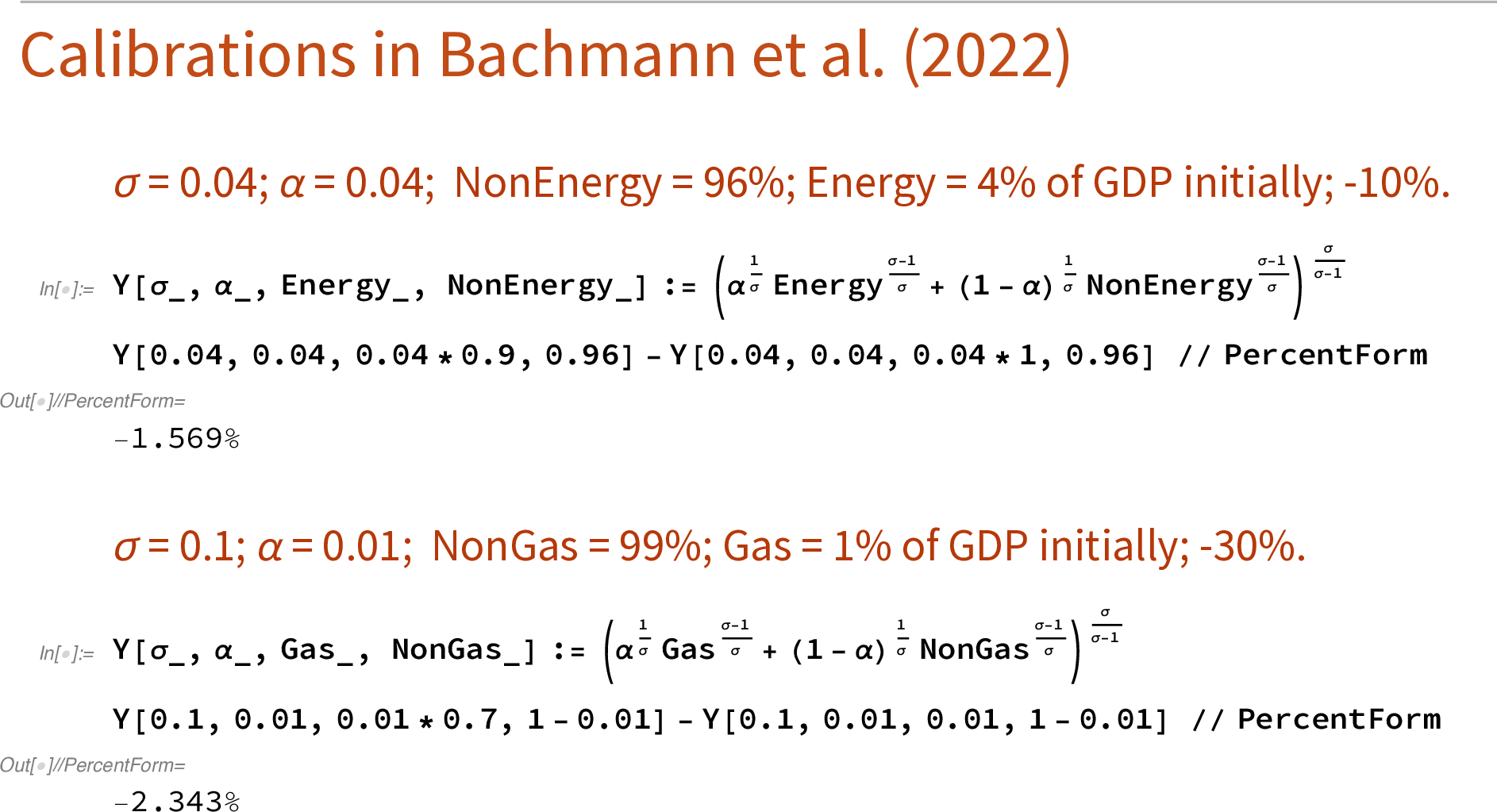

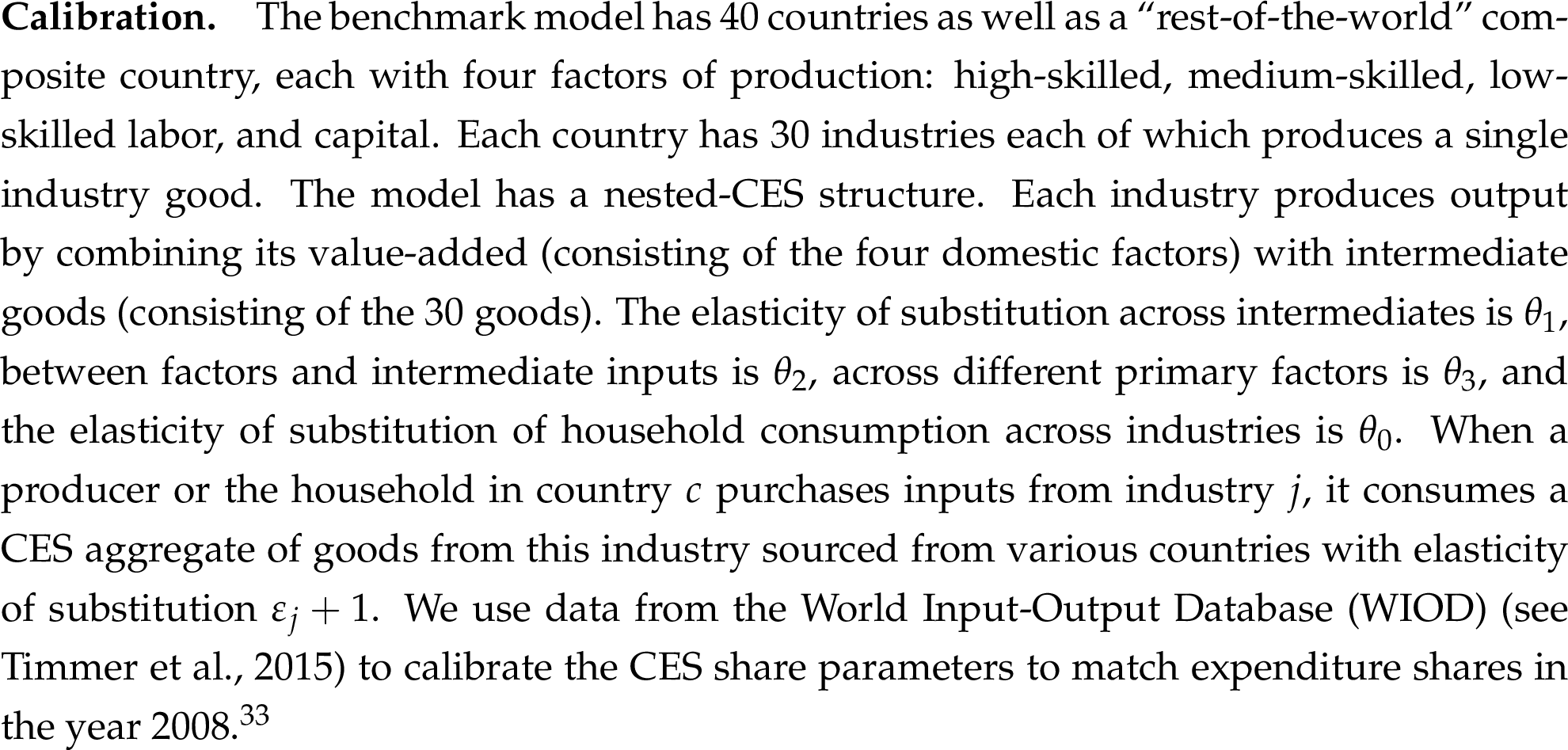

Bachmann, Ruediger, David Baqaee, Christian Bayer, Moritz Kuhn, Andreas Löschel, Benjamin Moll, Andreas Peichl, Karen Pittel, and Moritz Schularick. 2022.

“What If?

The

Economic

Effects for

Germany of a

Stop of

Energy

Imports from

Russia.” 36. ifo Institute - Leibniz Institute for Economic Research at the University of Munich.

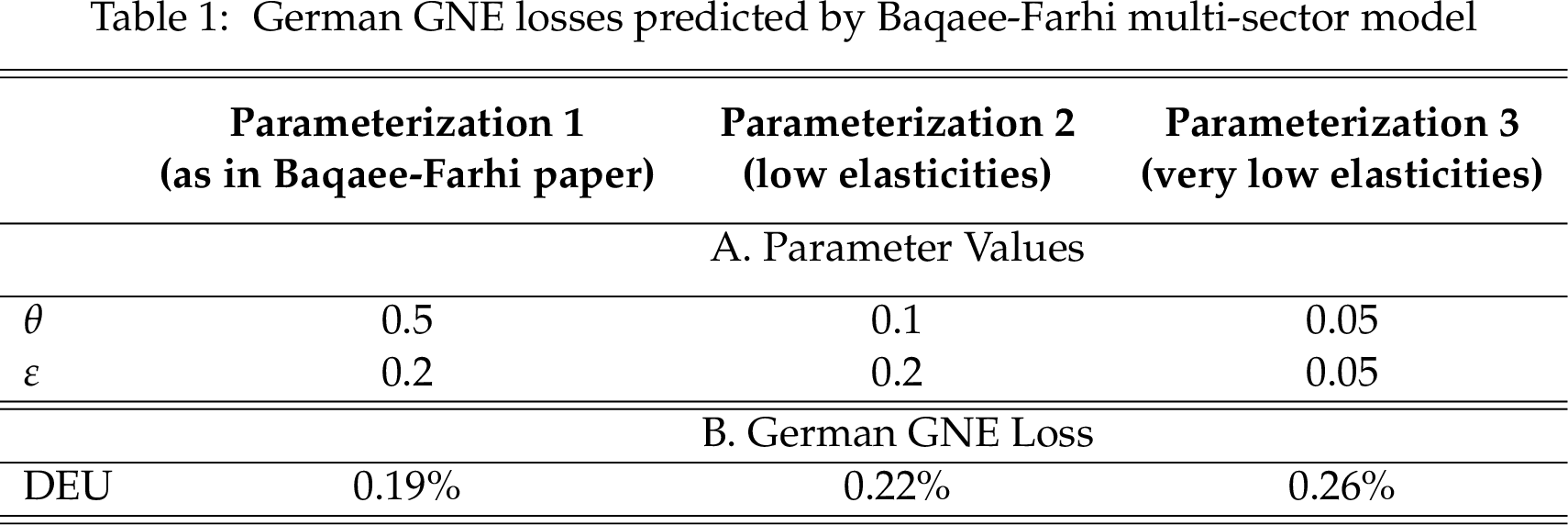

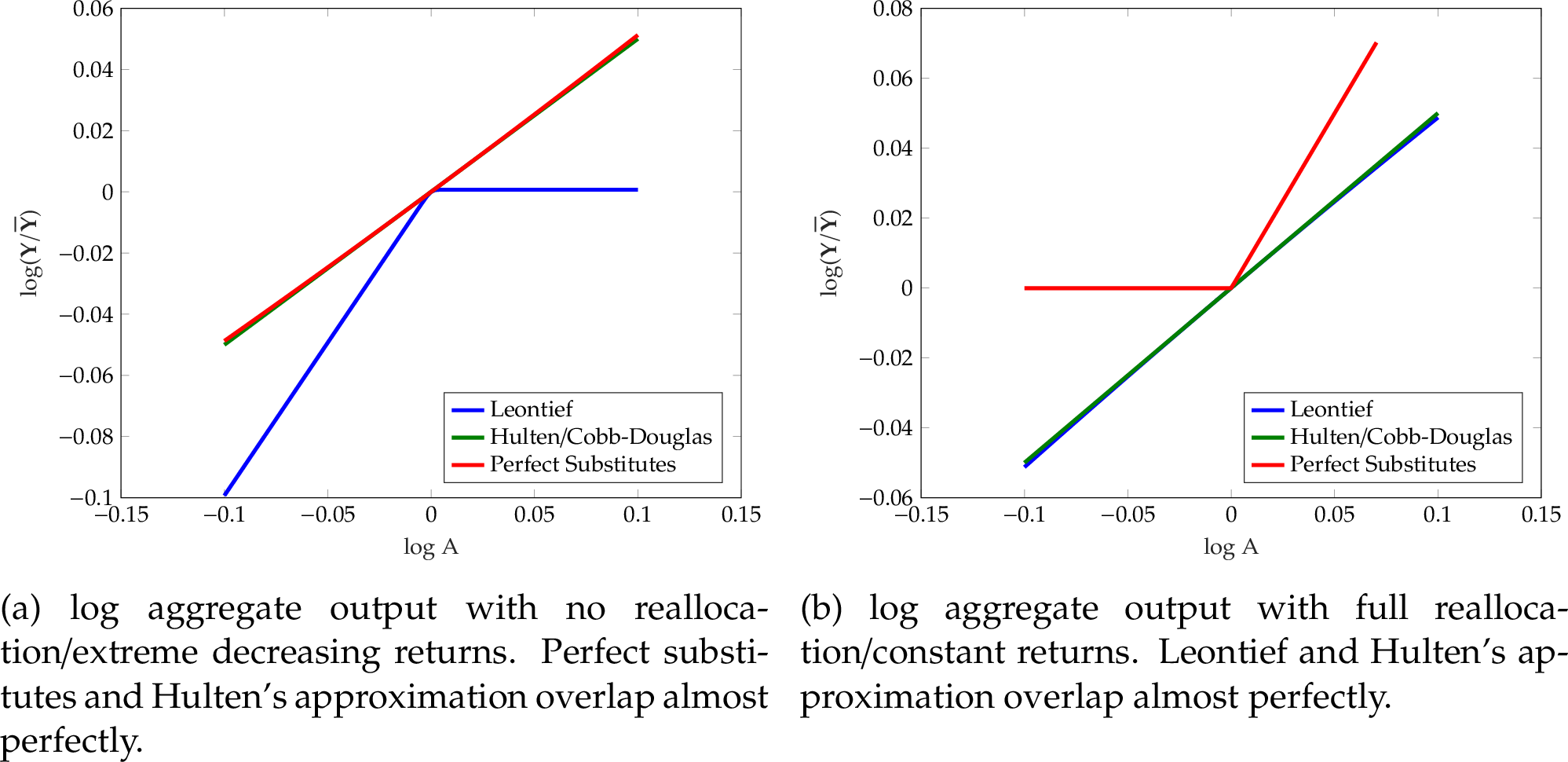

Baqaee, David Rezza, and Emmanuel Farhi. 2019a.

“The

Macroeconomic

Impact of

Microeconomic

Shocks:

Beyond

Hulten’s

Theorem.” Econometrica 87 (4): 1155–1203.

———. 2019b.

“

JEEA-

FBBVA

Lecture 2018:

The

Microeconomic

Foundations of

Aggregate

Production

Functions.” Journal of the European Economic Association 17 (5): 1337–92.

———. 2021.

“Networks,

Barriers, and

Trade.” Working {Paper} 26108. National Bureau of Economic Research.

Labandeira, Xavier, José M. Labeaga, and Xiral López-Otero. 2017.

“A Meta-Analysis on the Price Elasticity of Energy Demand.” Energy Policy 102 (March): 549–68.