|

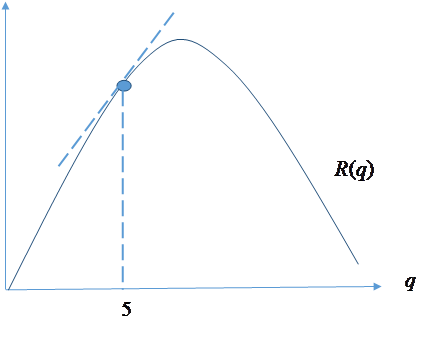

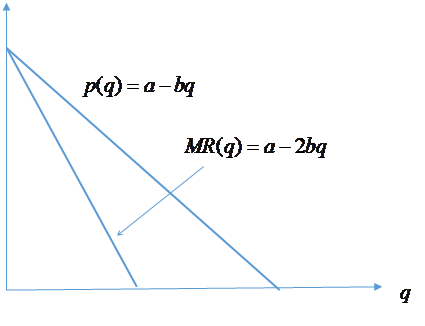

Marginal analysis and single variable calculus So much of economic analysis is about thinking on the margin in the pursuit of a more favorable outcome. Consider the choice of a firm that can produce a product at a cost of c per unit. The firm has some monopoly power. That is, it can raise its price without losing all of its customers and lower its price without being flooded with additional customers. For every price it sets, the market demand is As we shall see, it is helpful to “invert” this demand function and rewrite it as follows: Written this way, the equation is called the firm’s demand price function. If the firm chooses to supply q units to the market then p(q) is the market clearing price. Total revenue is then

Economists call the

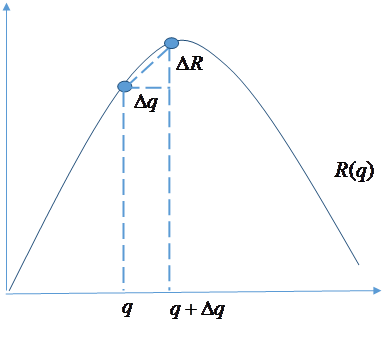

rate of change of revenue with output the marginal revenue, MR(q). This is the incremental revenue when output

increases from In some text books, marginal revenue is defined as the extra revenue from selling one more unit. But this typically not the case. A firm may be considering opening an additional plant that will increase capacity by 5%. If current sales are 10,000 units per month, then the incremental output is 500 units per month. Of course one could describe this as “one unit of output capacity” but this is unnecessary. The important point is that the increment in output is small. In modelling economics we often

ignore any indivisibility of a commodity and assume that a choice can be any

real number in some interval. We then

define marginal revenue to be the limiting rate of change as the increment in

output approaches zero. In the figure

below, as the increment approaches zero the rate of change (the steepness of

the chord the graph at a output level q. For our quadratic example, we first compute the slope the chord depicted below, that is we compute

If the slope of the

chord has a limit as The new revenue is The change in revenue is therefore

The slope of the chord is therefore The marginal revenue at

q is the limit as

In mathematical terms, marginal revenue is the derivative of the revenue function. We write the limit in one of the following ways:

Marginal profit is

marginal revenue If the right hand side is strictly positive, then the marginal profit is positive so the firm can increase its profit by increasing its output. If the right hand side is strictly negative, then the marginal profit is positive so the firm can increase its profit by decreasing its output. Thus the profit-maximizing monopoly chooses the output level From an economics perspective, this is not quite the whole story. Suppose that marginal profit is always negative. Note that this will be the case if and only if a < c. Then for any output q it is always more profitable to reduce output and so the profit-maximizing output is zero. In this introductory example, except

for language, the analysis is essentially the same as in a basic calculus

text. Revenue and cost (and hence

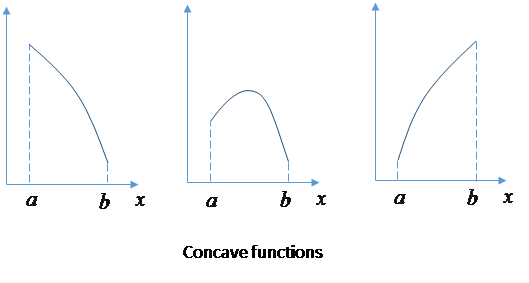

profit are defined for all positive real numbers, i.e. the interval Concave function

Thus if you find a

critical point Economists often work with concave functions. For a concave function the slope, Convex function Suppose a concave function is flipped upside down so that the slope is everywhere increasing. Mathematicians sometime say that such a function is concave upward. Economist always call such a function a convex function. |

|

|